For most returning NRIs, foreign assets are one of the biggest question marks. Can you keep your overseas bank account, property, or investments? Or does moving back to India mean liquidating everything abroad?

The good news is — India’s Foreign Exchange Management Act (FEMA) provides clarity through Section 6(4). This section allows returning NRIs to retain foreign property, bank accounts, and investments acquired while they were abroad. But the reality is that many still misunderstand the rules, especially when it comes to compliance with the Reserve Bank of India (RBI) and income tax reporting.

FEMA Section 6(4) – The Foundation Rule

Under FEMA Section 6(4), once you return to India, you are legally permitted to continue holding:

- Foreign bank accounts opened during your NRI status.

- Immovable property abroad purchased while you were a resident outside India.

- Investments like stocks, mutual funds, or bonds abroad.

- Income generated from these assets, such as rental income, interest, or dividends.

In January 2014, the RBI issued a clarification (AP Series Circular No. 90) to clear ambiguity. It confirmed that returning NRIs can freely retain and use foreign assets without RBI approval, provided they were acquired while the person was a non-resident.

This means you don’t need to rush to close accounts or sell property abroad when you move back. You can continue to hold, use, and even reinvest them.

Where the Confusion Comes From

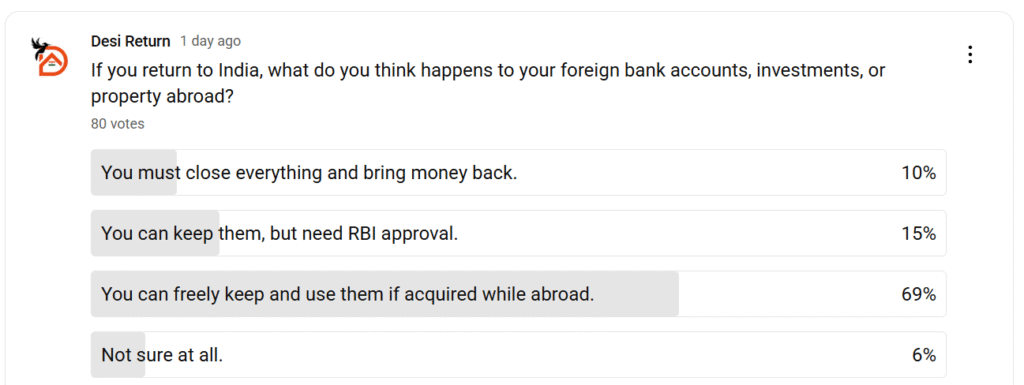

Despite the law being clear, many NRIs are still unsure about compliance. To test this, we ran a poll in the Desi Return community asking:

“If you return to India, what do you think happens to your foreign bank accounts, investments, or property abroad?”

Here’s how 80 respondents voted:

- 10% believed they must close everything and bring money back.

- 15% thought they could keep assets but only with RBI approval.

- 69% correctly said they can freely retain and use assets acquired abroad.

- 6% admitted they were not sure at all.

This shows that while a majority are somewhat aware, 1 in 3 returning NRIs are still either misinformed or completely unsure. That gap often leads to compliance mistakes, unnecessary asset transfers, or missed tax disclosures.

Our poll revealed that 31% of returning NRIs are either misinformed or uncertain about their rights. This is exactly where costly mistakes happen — like not converting accounts, failing to disclose assets on time, or unnecessarily liquidating investments abroad.

If you’re returning to India and unsure about compliance, our team can help with:

- Regulatory Compliance: FEMA declarations, RBI rules, asset retention.

- Tax Filings: Reporting foreign income, avoiding double taxation.

- KYC Updates: Seamless conversion of NRE/NRO/FCNR accounts.

Fill out this quick form and we’ll connect you with experts who specialize in cross-border regulatory compliance for NRIs.

Bank Account Conversions – NRE, NRO, FCNR, and RFC

While foreign assets can be retained, your Indian NRI accounts cannot remain the same once you move back. Here’s what happens:

- NRE Accounts: Must be converted into resident accounts or RFC (Resident Foreign Currency) accounts after return.

- NRO Accounts: Typically converted into resident accounts.

- FCNR Deposits: Can be held until maturity, after which they must be converted.

- RFC Accounts: Useful for returning NRIs who want to park foreign income in foreign currency in India without immediate conversion to INR.

This conversion is not optional. Banks require KYC updates and declaration of residential status. Failing to do so can result in penalties or blocked accounts.

Ambiguity Around Residency Status

Another issue is how “residency” is defined under FEMA versus the Indian Income Tax Act.

- Under Income Tax rules, residency depends on days of stay in India (≥182 days or 60+ days plus 365 days in previous 4 years).

- Under FEMA, residency is more about intent—if you’ve returned with the intention of staying indefinitely, you’re treated as a resident from that day.

A recent Tribunal ruling shook things up by applying the stricter Income Tax definition under FEMA too, creating uncertainty. Until clearer guidelines emerge, NRIs should carefully track both definitions to stay compliant.

Tax Filing & Foreign Asset Reporting

Here’s how taxation works for returning NRIs:

- If you qualify as RNOR (Resident but Not Ordinarily Resident), you don’t have to declare foreign assets immediately. Your global income is not taxable in India yet.

- Once you become ROR (Resident and Ordinarily Resident), you must report all foreign assets in your Income Tax Return (Schedule FA).

- Non-reporting of foreign assets can lead to penalties under the Black Money Act, 2015.

So, while FEMA lets you keep your assets, income tax law eventually requires disclosure and taxation once you become ROR.

What Returning NRIs Should Do

- Check your residency status (NR, RNOR, or ROR) under both FEMA and Income Tax.

- Inform banks of your return and convert NRE/NRO accounts.

- Retain foreign assets under Section 6(4) but keep documentation proving acquisition during NRI status.

- Plan for taxation—RNOR phase gives temporary relief, but ROR status brings full global taxation.

- Hire a CA or legal advisor to file FEMA declarations, update KYC, and ensure compliance.

If you need a professional CA to guide you through this process, fill out this form.

FAQs

Q1. Can I keep my foreign property after returning to India?

Yes, under FEMA Section 6(4), you can retain immovable property abroad purchased while you were a non-resident.

Q2. Do I need RBI approval to hold a foreign bank account?

No. RBI clarified in 2014 that such accounts can be retained and used freely.

Q3. How long can I hold my FCNR deposits after return?

You can hold them until maturity, after which they must be converted.

Q4. Do I need to declare foreign assets immediately after return?

Only when you become ROR. During NR or RNOR status, foreign assets don’t need to be reported.