Every year, thousands of Non-Resident Indians (NRIs) plan to move back to India. For many, the biggest concern is not just about adjusting socially, but financially. One of the least understood yet most critical aspects of this transition is your RNOR status (Resident but Not Ordinarily Resident).

This special category under the Indian Income Tax Act ensures that returning NRIs don’t face sudden and unfair tax liabilities. However, confusion around RNOR rules, eligibility, and benefits is widespread — and the risks of getting it wrong are costly.

What Is RNOR Status ?

RNOR stands for Resident but Not Ordinarily Resident. It’s a transitional residential status recognized by the Income Tax Act, 1961.

When you return to India after living abroad, you don’t immediately become a Resident and Ordinarily Resident (ROR). Instead, if you meet specific conditions, you are classified as RNOR for a limited time.

This middle category ensures your foreign income is not taxed in India right away, while you adjust financially and legally to residency.

RNOR Status India: Rules and Eligibility

Your RNOR eligibility is based on:

- Number of days in India

- You must have stayed in India 729 days or less in the last 7 years, OR

- Non-Resident record

- You must have been an NRI for 9 out of the last 10 financial years.

If either of these conditions is met, you qualify as RNOR.

Example of RNOR Calculation

Suppose an NRI returns in FY 2025–26:

- Stayed only 500 days in India during the last 7 years.

- Was an NRI for 9 of the last 10 years.

✅ This person qualifies as RNOR.

If, however, they exceed 729 days OR were resident in more than 2 of the last 10 years, they become Resident and Ordinarily Resident (ROR).

RNOR Benefits India

The biggest reason NRIs must understand RNOR is its tax benefits:

- Foreign income is not taxed in India (unless it’s received directly in India).

- NRE, FCNR deposits continue to enjoy exemptions.

- DTAA (Double Tax Avoidance Agreement) can still apply, reducing double taxation risks.

- Flexibility to restructure investments and assets before becoming a full resident.

In essence, RNOR status acts as a buffer zone — allowing you time to plan without being taxed on global income.

RNOR vs NRI vs Resident: Key Differences

| Category | Definition | Tax Implication |

| NRI | Non-resident under the Income Tax Act | Foreign income not taxed in India |

| RNOR | Transitional resident status for returning NRIs | Only Indian-sourced income taxed; foreign income largely exempt |

| ROR (Resident and Ordinarily Resident) | Full resident under Indian tax law | Global income taxable in India |

This comparison shows why RNOR is highly valuable — it gives returning NRIs breathing room to align finances.

RNOR Rules India: How Long Can You Be RNOR?

Your RNOR status is determined each year at the time of filing income tax, based on the residential status criteria in the Income Tax Act — not a fixed approval from the CBDT.

In practice, an individual can typically be classified as RNOR for a maximum of 2–3 financial years after returning to India. After this period, if you no longer meet the conditions, you transition into Resident and Ordinarily Resident (ROR) and your global income becomes taxable in India.

Common Mistakes Returning NRIs Make

Based on community conversations, here are frequent errors:

- Believing RNOR = NRI → leading to wrong tax filings.

- Ignoring foreign assets reporting once RNOR lapses.

- Failing to restructure NRE/NRO/FCNR accounts in time.

- Assuming RNOR lasts indefinitely.

- Not consulting a tax consultant until it’s too late.

Each of these mistakes can cost thousands in unnecessary tax payments.

Returning NRIs on RNOR Status

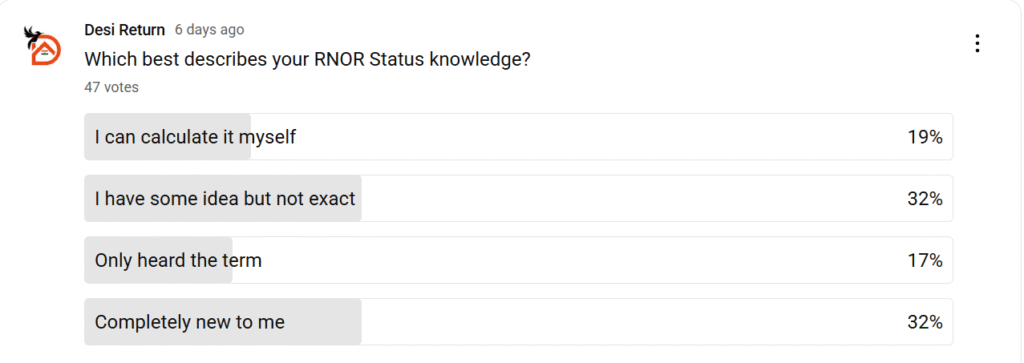

When we spoke to our community of returning NRIs, one thing became clear — most people are still unsure about RNOR status and its benefits. To see how widespread this confusion really is, we ran a quick poll:

👉 “Which best describes your RNOR Status knowledge?”

Here’s how 38 people responded:

- 37% – Completely new to RNOR

- 34% – Have some idea but not exact

- 16% – Only heard the term

- 13% – Confident they can calculate it

💡 Key insight: Almost 70% of NRIs don’t fully understand RNOR status. That means many returning families are either paying more tax than they should — or risking compliance issues with the CBDT (Central Board of Direct Taxes).

This tells us something important: while RNOR is designed to make your transition smoother, most NRIs aren’t clear on how it works.

Why Most NRIs Misunderstand RNOR

Our poll showed that only 13% could confidently calculate their RNOR status. Why is it so confusing?

- Complex calculation rules under the Income Tax Act.

- Lack of awareness of the 7-year / 10-year criteria.

- Misleading advice from peers, instead of expert consultants.

- RNOR’s temporary nature — unlike NRI or ROR, it’s not permanent.

This is why so many returning NRIs face compliance risks and tax penalties.

And this is exactly why planning RNOR properly is so important. It’s not just about counting days; it’s about understanding how your salary abroad, NRE deposits, pensions, investments, and foreign assets interact with Indian tax law.

The best way to avoid costly mistakes is by working with a CA who specializes in cross-border taxation. The right guidance can help you:

- Maximize RNOR tax benefits.

- Avoid errors in tax filings.

- Transition smoothly into full residency without compliance risks.

If you’d like to connect with such experts, fill out this form and we’ll guide you:

Get Expert RNOR Guidance →

RNOR Eligibility Tools & Calculators

For returning NRIs who want to self-check their RNOR status, Desi Return has built a simple RNOR Status Calculator.

Try it here: RNOR Status Calculator

This tool helps you quickly understand whether you qualify as RNOR based on your days of stay and past residency record.

Of course, while a calculator is useful, it doesn’t capture the nuances of income, investments, or cross-border assets. For complete clarity and tax planning, it’s always best to follow it up with expert guidance.

If you’d like to connect with such experts, fill out this form and we’ll guide you:

Get Expert RNOR Guidance →

FAQs on RNOR Status

1) What exactly is RNOR status?

RNOR (Resident but Not Ordinarily Resident) is a transitional Indian tax residency category for people returning to India. It sits between NRI and full resident (ROR).

2) Who qualifies as RNOR?

You’re RNOR in a year if you are resident for that year and either:

- Were non‑resident in 9 of the previous 10 years, or

- Were in India ≤729 days in the previous 7 years.

3) Does the 120‑day rule make me RNOR?

If you’re an Indian citizen/PIO with India‑sourced taxable income > ₹15 lakh, and you visit India for 120–181 days, you become resident and typically RNOR for that year.

4) How long can someone remain RNOR?

RNOR is not indefinite. Based on income tax rules, you can generally hold RNOR status for a maximum of about 3 years after returning to India.

5) What income is taxable for an RNOR?

RNORs are taxed in India on:

- Income received/deemed received in India

- Foreign income from a business controlled in, or a profession set up in, India.

Foreign income earned and received outside India is not taxed in India during RNOR years.